You need real-time data to make informed decisions as a trader or investor, and markets run 24/7, so prices shift. You need to extract and analyze data efficiently.

Python is the tool for this job; you can fetch real-time prices via APIs or scrape crypto exchanges for more insights. Once you have the data, you can clean, store, and analyze it to find trends and opportunities.

In this article, we’ll go over how to extract cryptocurrency price data with Python, clean it for accuracy, and analyze it with statistical and visualization techniques. Let’s get started!

Table of Contents

- Why Extracting Cryptocurrency Price Data Matters

- Setting Up Your Environment for Crypto Data Extraction

- Extracting Cryptocurrency Price Data with Python

- Fetching Real-Time Crypto Prices

- Extracting Historical Crypto Data

- Loading and Preparing the Data

- Calculating Moving Averages for Trend Analysis

- Visualizing Cryptocurrency Price Trends

- Detecting Market Volatility with Bollinger Bands

Why Extracting Cryptocurrency Price Data Matters

Cryptocurrency prices change in seconds. Traders, investors, and analysts need real-time and historical price data to make informed decisions, predict trends, and optimise trading strategies. For investors, a crypto portfolio tracker can provide a holistic view of their holdings and overall performance based on this fluctuating price data. Getting cryptocurrency price data helps with:

- Trend Following – See price movements to spot bullish or bearish trends.

- Trading Strategies – Use price data to build algorithmic trading models.

- Sentiment Analysis – Historical data to see how the market reacts to news and events.

- Exchange Comparison – Prices differ across exchanges, creating arbitrage opportunities.

Setting Up Your Environment for Crypto Data Extraction

Before extracting cryptocurrency price data, you need to set up a Python environment with the right tools. Python provides powerful libraries that make data extraction and analysis efficient.

1. Install Required Libraries

You need libraries for making API requests, handling data, and visualizing trends. Install them using:

1 | pip install requests pandas matplotlib |

- requests – Fetches data from cryptocurrency APIs.

- pandas – Handles and processes the extracted data.

- matplotlib – Helps visualize price trends.

2. Choose a Data Source

Cryptocurrency exchanges and financial platforms offer APIs for accessing real-time and historical price data. Popular options include:

- Binance API – Provides real-time market data.

- CoinGecko API – Offers free access to price history.

- CoinMarketCap API – Aggregates data from multiple exchanges.

3. Get API Access

Most APIs require an API key for authentication. Sign up on your preferred platform, generate an API key, and keep it secure.

4. Set Up a Python Script

Create a new Python script (crypto_scraper.py) and import the necessary libraries.

1 | import requests |

Now that your environment is ready, you can start extracting cryptocurrency price data and analyzing market trends.

Extracting Cryptocurrency Price Data with Python

Once your environment is set up, you can start extracting cryptocurrency price data using APIs. Python makes this process easy with libraries like requests for API calls and pandas for data handling. Below, we’ll explore how to fetch real-time and historical crypto price data from different sources.

Fetching Real-Time Crypto Prices

You can use the CoinGecko API to get the latest price data for Bitcoin and other cryptocurrencies.

1 | import requests |

Example Output:

1 | Bitcoin Price: $86650 |

This script sends a request to CoinGecko and retrieves Bitcoin’s current price in USD. You can modify it to get prices for other cryptocurrencies by changing the ids parameter.

How to Extract Historical Crypto Data

If you need past price data to analyze trends, you can use the Binance API to get historical candlestick (OHLC) data.

1 | import requests |

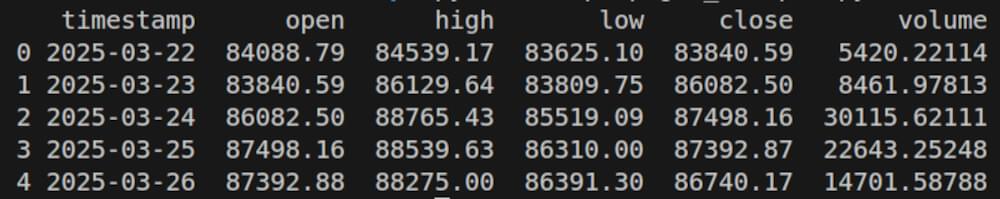

Output Snapshot:

This script gets the last 5 days of Bitcoin data from Binance, and open, high, low and volume, low and close and volume. The data is then converted into a pandas DataFrame for further analysis.

With this, you can get and store real-time or historical crypto data for trend analysis, trading strategies, and market predictions. Next, we will see how to analyze this data with Python.

Analyzing Cryptocurrency Price Trends with Python

Once you have the cryptocurrency price data, the next step is to analyze the trends and patterns. Python has powerful libraries like pandas, matplotlib, and numpy to process and visualize the data, so it’s easier to see the market movements.

Loading and Preparing the Data

Before analysis, make sure your data is clean and properly formatted. If you already have historical price data, you can load it into a Pandas DataFrame for further processing.

1 | import pandas as pd |

Calculating Moving Averages for Trend Analysis

Moving Averages (MA) help smooth out price fluctuations and reveal overall trends. The 50-day and 200-day moving averages are commonly used indicators in technical analysis.

1 | # Calculate 50-day and 200-day moving averages |

Visualizing Cryptocurrency Price Trends

Plotting price movements helps identify patterns and potential trading signals. Using Matplotlib, you can visualize historical prices along with moving averages.

1 | import matplotlib.pyplot as plt |

This graph visually represents Bitcoin’s price movements and how it interacts with moving averages. If the short-term moving average (50-day) crosses above the long-term moving average (200-day), it could signal a bullish trend, whereas a crossover below might indicate a bearish trend.

Detecting Market Volatility with Bollinger Bands

Bollinger Bands help measure market volatility by showing price fluctuations around a moving average.

1 | # Calculate Bollinger Bands (20-day moving average with standard deviation) |

When prices approach the upper band, the market may be overbought, whereas touching the lower band could indicate an oversold condition. Traders use these signals to make informed decisions.

Power Your Crypto Data Projects with Crawlbase

Extracting cryptocurrency data using Python is a powerful approach for market analysis, trading strategies, or building personal dashboards. However, many crypto websites have anti-scraping measures that can slow you down or stop your project altogether.

That’s where Crawlbase comes in.

Why Use Crawlbase for Crypto Data Extraction?

Bypass Site Restrictions: Crawlbase automatically handles IP rotation, CAPTCHAs, and JavaScript rendering, making it easier to extract data from even the most protected crypto platforms.

Save Time and Resources: No need to manage proxy servers or build scraping infrastructure from scratch. Crawlbase delivers clean, ready-to-use HTML, allowing you to focus on data insights.

Reliable at Scale: Crawlbase is built to scale with your needs. You can track a handful of tokens or monitor thousands of data points across multiple exchanges.

Sign up now. You can combine the flexibility of Python with the reliability of Crawlbase.

Frequently Asked Questions

Q. Is it legal to scrape cryptocurrency price data?

Web scraping is legal if you follow the website’s terms of service and don’t scrape restricted data. The best approach is to use official APIs like Binance, CoinGecko, or CoinMarketCap to be compliant.

Q. What is the best way to analyze cryptocurrency price trends?

You can analyze price trends using Python libraries like Pandas for data processing, Matplotlib for visualization, and NumPy for statistical calculations. Moving averages, volume trends, and volatility indicators can help you spot market patterns.

Q. How often should I collect cryptocurrency data for analysis?

It depends on your needs. For real-time trading, you may need updates every few seconds; for long-term trend analysis, daily or hourly data may be enough. Using APIs, you get the latest prices efficiently.